san antonio local sales tax rate

The County sales tax rate is. The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta.

Nike Kd Trey 5 V Royal Blue White Athletic Basketball D 897638 400 Men S Shoes In 2022 Royal Blue Shoes Nike Basketball Shoes Nike

The December 2018 total local sales tax rate was also 8250.

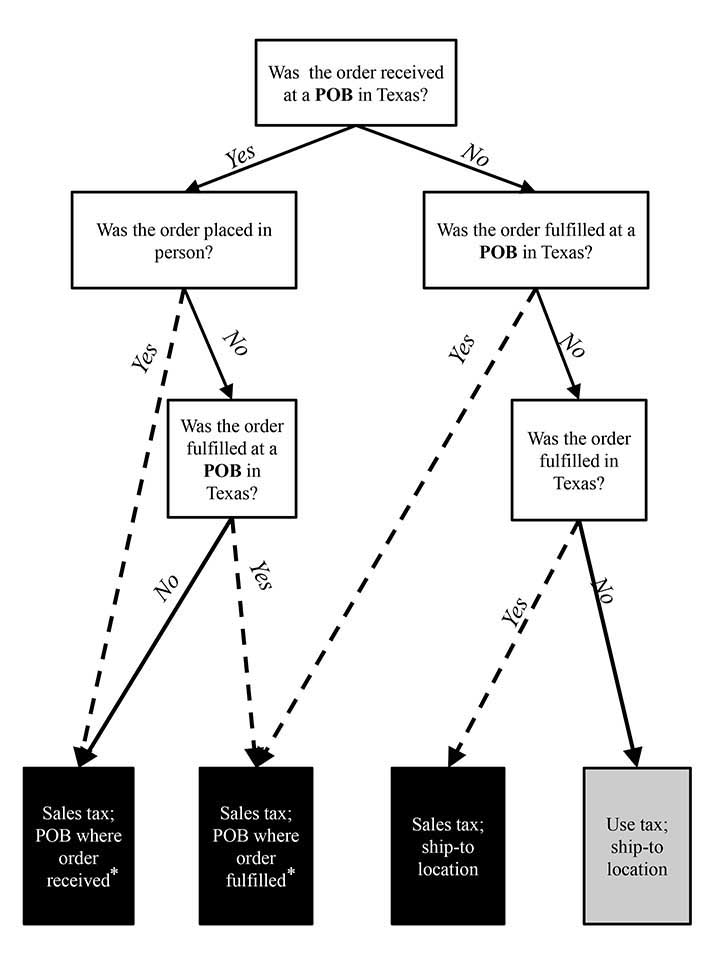

. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. This is the total of state county and city sales tax rates. Total State Local Rate.

For tax rates in other cities see Florida sales taxes by city and county. The current total local sales tax rate in San Antonio TX is 8250. The portion of the sales tax rate collected by San Antonio is 125 percent.

San Antonio has parts of it located within Bexar County and Comal County. The current sales tax rate in San Antonio Texas is 783 percent. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

San Antonio TX Sales Tax Rate The current total local. The minimum combined 2022 sales tax rate for San Antonio Florida is. The San Antonio sales tax rate is.

This is the total of state county and city sales tax rates. Bexar Co Es Dis No 12. Applicable Sales Tax Current Rate Local Sales Tax Revenue in Millions City Tax.

The Florida sales tax rate is currently. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. The average cumulative sales tax rate in San Antonio Texas is 822.

San Antonio collects the maximum legal local sales tax. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

Postal p 7 years ago. There is no applicable county tax. Sport Community Venue Tax.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonio has a higher sales tax than 100 of Texas other cities and counties. The San Antonio sales tax rate is a rate of tax a consumer must pay when purchasing goods and some services in Bexar County Texas and that a business must collect from their customers.

The County sales tax rate is. The December 2020 total local sales tax rate was also 8250. This is the total of state county and city sales tax rates.

Ad Lookup Sales Tax Rates For Free. Did South Dakota v. The Official Tax Rate.

You can print a 7 sales tax table here. The San Antonio Texas general sales tax rate is 625. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction.

The current total local sales tax rate in San Antonio TX is 8250. The San Antonio sales tax rate is. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Local sales taxes are collected in thirty-eight states. The Texas sales tax rate is currently. San Antonio Mta Sales Tax Rates for 2022.

The minimum combined 2022 sales tax rate for San Antonio Texas is. The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a.

San Antonio Sales Tax Rates for 2022. What is the sales tax rate in San Antonio Texas. Public Sale of Property PDF Bidder Request.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. The five states with the highest average combined state and local sales tax rates are Louisiana 1002 percent Tennessee 945 percent Arkansas 934 percent Washington 920 percent and Alabama 903 percent. 05 lower than the maximum sales tax in FL.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community Venue Municipal Development and Street. This includes the rates on the state county city and special levels. There is no applicable city tax or special tax.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. Interactive Tax Map Unlimited Use. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

You can find more tax rates and allowances for San. San Antonio Mta in Texas has a tax rate of 675 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio Mta totaling 05. Within San Antonio there are around 82 zip codes with the most populous zip code being 78245.

You can find more tax rates and allowances for San Antonio Mta and Texas in the 2022 Texas Tax Tables. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. City of San Antonio Total.

Does once apon a child offer trade in and how does it work in San antonio. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Agua Dulce Nueces Co 2178051010000077500.

The San Antonio sales tax rate is 825 What is Texass tax rate.

Vape E Cig Tax By State For 2022 Current Rates In Your State

Global Shoppers You Don T Have To Pay Us Sales Tax

2021 Housing Forecast In 2021 Real Estate Marketing Housing Market Real Estate Infographic

Local Sales And Use Tax Collection A Guide For Sellers

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

As Sales Tax Drops In Nm Hard Choices Await Albuquerque Journal

Texas Sales Tax Guide And Calculator 2022 Taxjar

Tax Rates Bexar County Tx Official Website

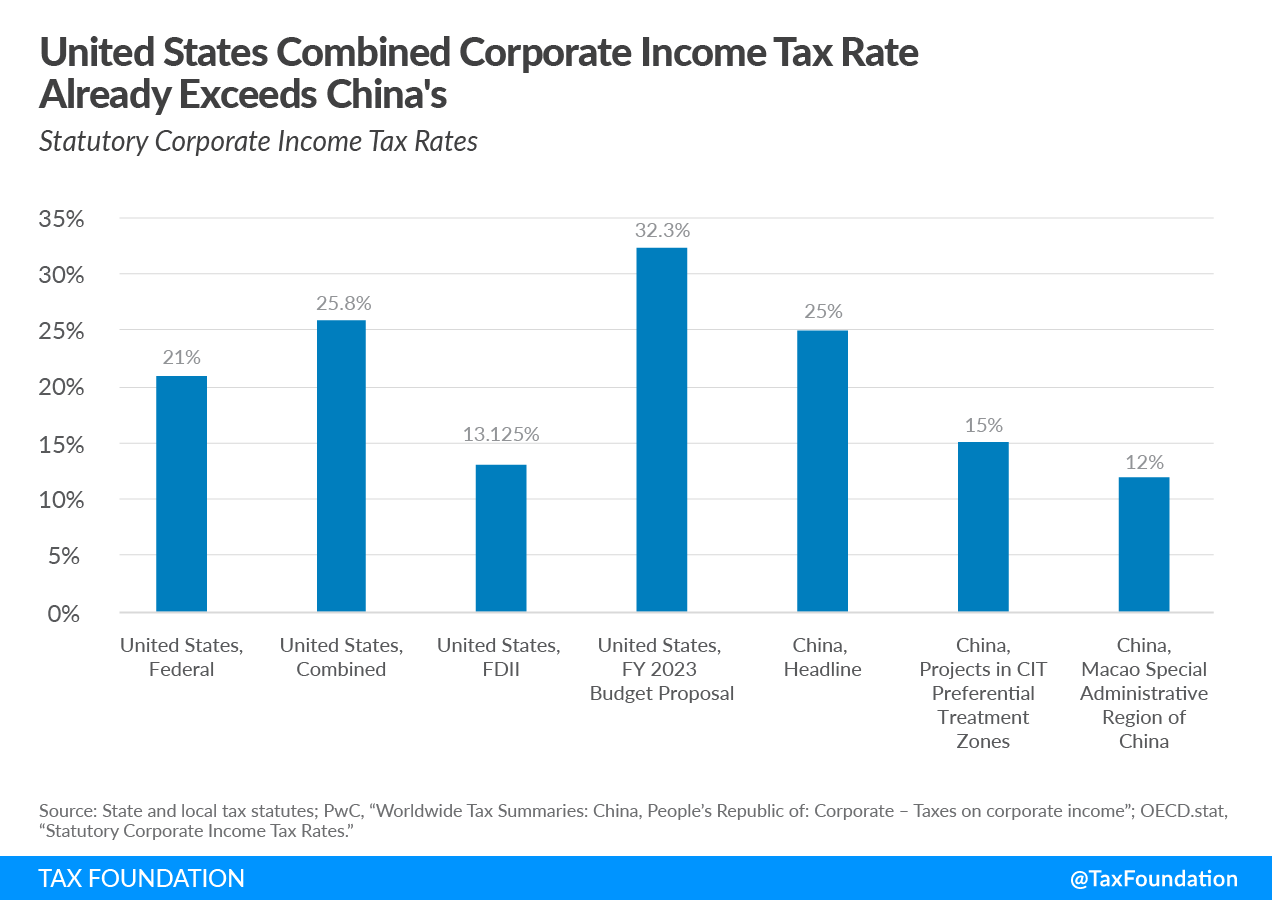

Business Tax Compliance And Complexity Tax Foundation

Texas County Challenge Texas County Map Texas County Texas Map

Texas Sales Tax Guide And Calculator 2022 Taxjar

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

Business Tax Compliance And Complexity Tax Foundation

Hey Guys Visit Our Site Those Who Want To Buy Home For The First Time And Comparemortgagerate Easily With Mor Current Mortgage Rates Mortgage Rates Mortgage

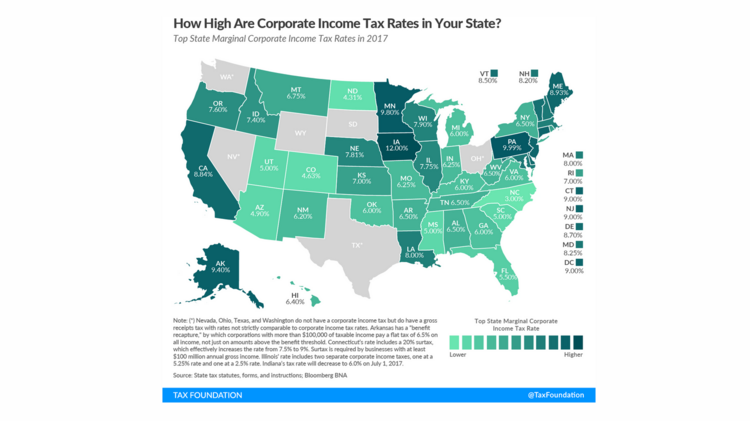

Colorado Goes Easy On Corporate Income Taxes Denver Business Journal

Why Are Texas Property Taxes So High Home Tax Solutions

Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal